Contents:

The bears are in control when three inside up patterns begin to form. Trading is about the tug of war between the bulls and the bears. When one side doesn’t like what the other side is doing, they come in to take over . It means for every $100 you risk on a trade with the Three Inside Up and Three Inside Down pattern you make $6.2 on average.

The second candle forms inside the body of the previous candle, becoming a so-called inside bar. First, the middle candle intersects with the 23.6% Fibonacci level, which can be the first entry-level. The next two examples occur during an overall price rise and occur during pullbacks against that rise. Once the pattern occurs, the price begins to move higher again, although not necessarily right away.

It will make me a millionaire within few months with a little effort. The Bullish Three Inside Up Candlestick Pattern is just one of a series of candles that signify that either a reversal or a continuation of a trend is a highly probable event. Although these patterns can be powerful indicators in their own right, it is always advisable to use additional technical tools to confirm the timing of your desired plan of attack.

What is the Three Inside Up Pattern?

It is going to depend on how big risk you are willing to bear. When trading options, keep the position open at least three times as long as the timeframe of the chart you are using. Notice how traders react when price is trading around moving average lines; especially those like the 50 and 200 SMA’s. You may notice a lot of patterns occurring around moving average lines as well as away from them.

This https://forexhero.info/ , however, is often not particularly significant. Still, you can use the pattern in the general trend context and catch price retracements. These are the clues traders look for and pay attention to. If you want to be a successful trader, you’ll learn to as well . Price that has moved away from moving averages is always going to come back to them whether above or below. RSI will also alert you to a stock being oversold or overbought.

The third candlestick acts as a confirmation that a reversal is in place, as the candle closes beyond the midpoint of the first candle. Take time on your demo system to search for other examples in the archived data to assess how bodies and wicks can vary and what the variances might portend. Three Inside Up and Three inside Down are dependable reversal patterns also comprising a trio of consecutive candles.

How to Trade the Bullish Three Inside Up Candlestick Forex Pattern

Because the third candlestick represents breakout of high of the inside bar and bearish candlestick. It represents a bearish trend reversal and resembles a morning star pattern. When it forms at the end of a bearish trend then it will indicate the end of the previous trend. To identify triple Japanese candlestick patterns, you need to look for specific formations that consist of three candlesticks in total.

Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. New buyers with a risk appetite see this as a reversal sign and an opportunity to enter the trade.

A trading strategy is a crucial foundation for traders to follow throughout the trading process. The technical storage or access that is used exclusively for anonymous statistical purposes. Open a long position when the last candle in the formation is about to close or when the next candle begins to develop. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP. It can just be used as an alert that the short-term price direction may be changing. If you see a grouping of candles that seem to be the opposite of this one , you may have located a three inside up/down candlestick pattern.

Technicals of Three Inside Up Patterns

To avoid being abruptly halted out on a long position, it would have been wise to have a stop loss set below the whole pattern. Since the sequence is pretty typical, it is not always trustworthy. Additionally, the pattern is short-term in nature, which could result in only a small to medium move in the new direction, even though it occasionally causes significant trend changes. According to the design, the price might not move in the anticipated direction but instead turnabout and go back in line with the initial trend.

This may mean the downturn is finished, and the upswing is https://traderoom.info/ting again. The secondary candle is white , has a natural body, and opens and shuts inside the first candle’s natural body. Use these patterns in light of a more significant trend, if possible.

According to Bulkowski, this reversal predicts higher prices with an 65% accuracy rate. They are a four candlestick pattern that takes place near support levels. The next three candlesticks are bullish and each have a candlestick close above the previous one. Look for price action to rise above the fourth candle and hold for bullish continuation.

In this case, you need to wait for the third confirmation candle to over and close above the second candle. Below, we will show two of these methods to help you confirm the three inside-up trend reversal patterns and find the ideal level to get in and out of a position. All three candles must have a long body and very small (or non-existent) upper shadows. Besides, all three candlesticks should open within the previous candle’s real body and have a close exceeding the previous high, indicating the bulls are pushing the price up.

These patterns can appear quite often and will not always signify that the price is set to trend in a new direction. The third candle is a white candle that closes above the close of the second candle. These patterns are short-term in nature, and may not always result in a significant or even minor trend change. During a downtrend, look for the three inside downs that precede a small upward move.

- TradeVeda.com and its authors/contributors are not liable for any damages and/or losses caused due to trading/investment decisions made based on the information shared on this website.

- These parameters increase the winning probability of a trading strategy.

- Key takeaways A morning star pattern is a bullish 3-bar reversal candlestick patternIt starts with a tall red candle,…

- This is a free account that perfectly serves practice purposes.

- Even though many new traders will try to apply the three insider secrets to their market as soon as they learn about it, this is not a good idea!

- The pattern’s up version is bullish, suggesting that the price move lower may be coming to an end and a rise higher is about to begin.

Swing traders, in essence, are a type of active traders, so they stay in the market for a short period to try and quickly gain profits. The third candle closes above the first, which buyers may see as an opportunity to invest for the long term. Don’t get bogged down if your bullish harami doesn’t form this “pregnant” shape. As long as the second candle is contained within the first, you have achieved the harami. When the last candle in the formation is about to close or the following candle begins to develop, open a long position.

An analysis that can significantly improve the reliability of a three inside up pattern is the Relative Strength Index . To help you correctly identify the three inside up pattern, let us quickly review the overall construction of this pattern and its key characteristics. Risk management refers to the practices that are put in place while trading to assist in keeping losses under…

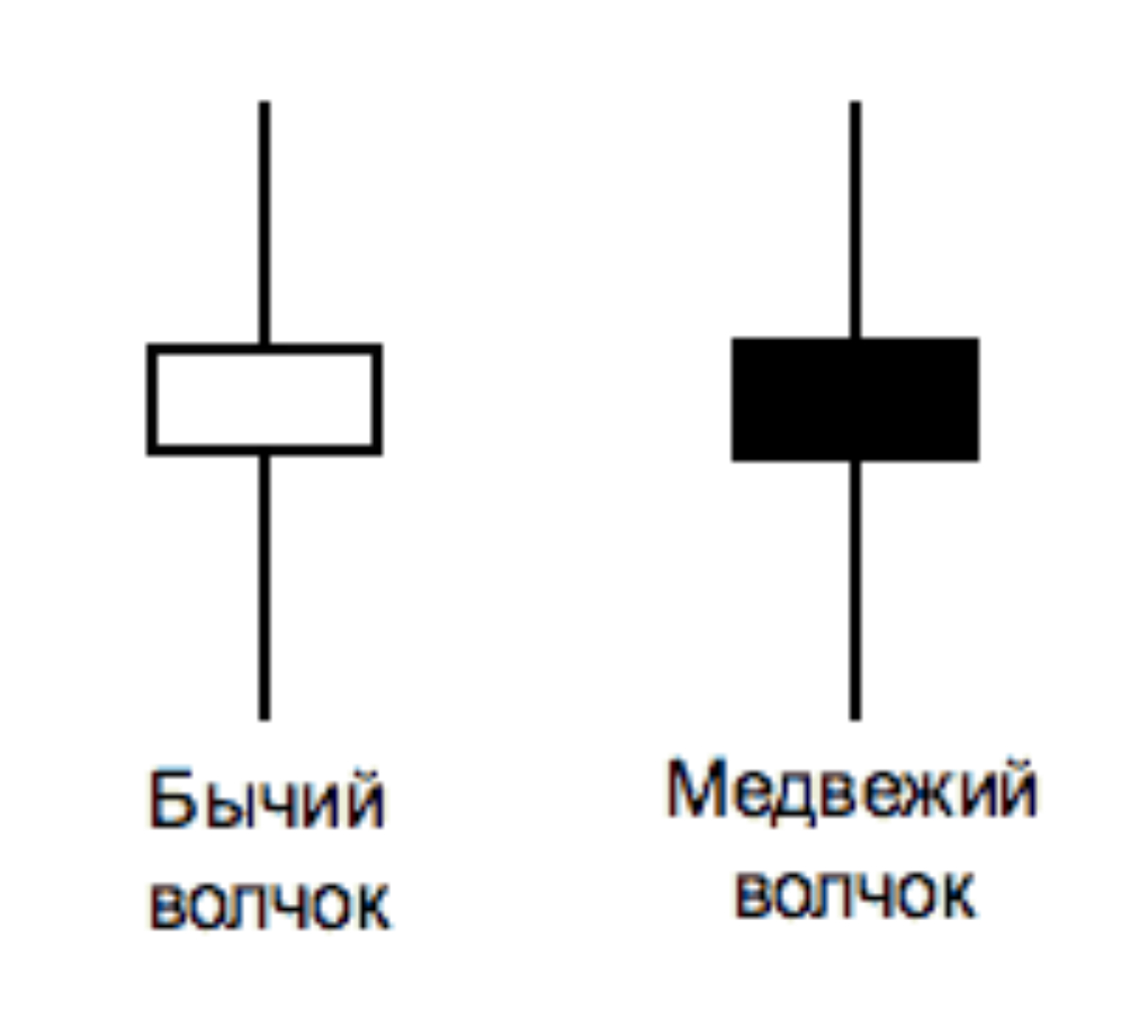

This price action raises a red flag, which some short-term short sellers may use as an opportunity to exit. Three Inside Up is considered bullish and is formed at the end of a downtrend. In this formation, a bearish trading candle with a long body is followed by a bullish one, enclosed inside it. As for the third, it has to close above the close price of the second.

Three Keys and a Pick: Iowa at No. 15 Indiana – 247Sports

Three Keys and a Pick: Iowa at No. 15 Indiana.

Posted: Tue, 28 Feb 2023 15:45:16 GMT [source]

It will draw real-time zones that show you where the price is likely to test in the future. I will recommend you trade this pattern with your own method. But I will also recommend a strategy that can be used to trade this pattern. This will be an effective strategy and you can also modify by backtesting according to your temperament. A trading strategy is a combination of many parameters and confluences.

My name is Navdeep Singh, and I have been an active trader/investor for almost a decade. For some people it is a passive way of earning some extra cash, while for others it is a rather active way of earning full-time income. Place your S/L order at the low price of the first, second, or third candle.

Key takeaways A https://forexdelta.net/ pattern is a bullish 3-bar reversal candlestick patternIt starts with a tall red candle,… The patterns do not have profit targets; therefore, it is best to use another method for deciding when to take profits, if they develop. This could include using a trailing stop-loss, leaving at a particular risk/reward ratio, or making use of technical indicators or other candlestick patterns to indicate an exit. Formation of this candlestick pattern speaks about the market sentiments that the bulls are trying to take over the bears. The third day formation of a bullish candle, forming a new high, offers more confirmation of bulls rally is going to continue. Some candlestick patterns are reversal patterns, which indicate the end of the current trend and the beginning of a new trend in the opposite direction.

You could use the TickTrader platform to explore technical analysis tools and charts. The Evening Star pattern is mostly used to predict future price declines. The volume is also important for this pattern as for Morning star.