Content

Straight-line depreciation is different from other methods because it is based solely on the passage of time. Estimate the useful life of the asset, meaning, how long it is expected to be in service. Some assets experience accelerated obsolescence in their early years, such as computers and vehicles.

At the point where this amount is reached, no further depreciation is allowed. Suppose an asset straight line depreciation for a business cost $11,000, will have a life of 5 years and a salvage value of $1,000.

To deduct certain expenses on your financial statements

Straight line basis is calculated by dividing the difference between an asset’s cost and its expected salvage value by the number of years it is expected to be used. Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Kirsten https://quickbooks-payroll.org/ is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. Here, we are simply taking an average of the useful value of the asset over its useful life. The useful life can be of any frequency, be it years, quarters, months, etc., but remember then that the depreciation value will be the value per period.

- Then, you divide by the number of units expected for its lifespan.

- Robust automated accounting NetSuite Cloud Accounting Software, can take over this tedious process, reducing the potential for error and freeing employees to work on higher-value activities.

- For instance, let’s take an example of Acer Computer, which buys a $2,000 McAfeeantivirus software that won’t be used for five years, and its estimated residual value is $500.

- You can calculate the declining balance method by multiplying a fixed depreciation rate by the current book value .

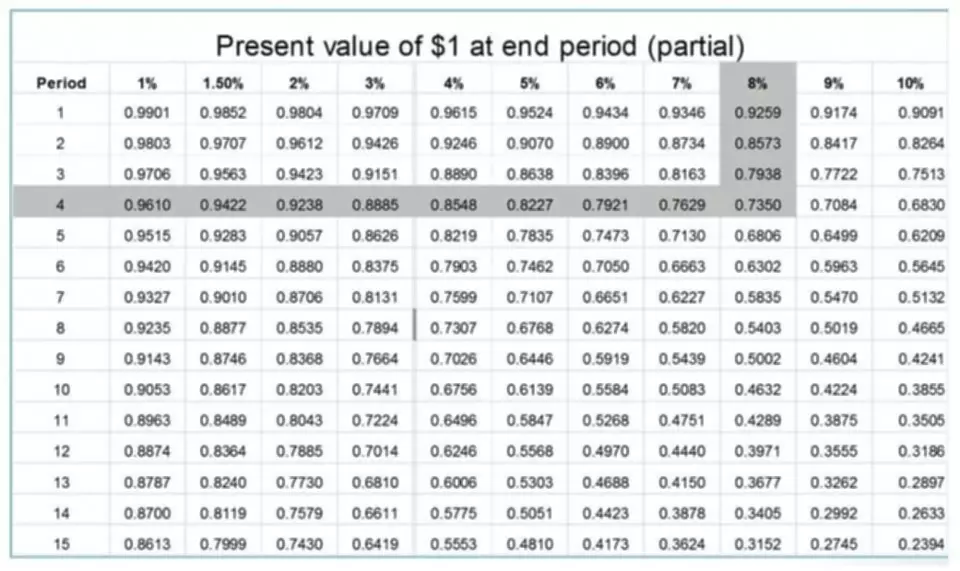

However, the downside is that it does not reflect the true cost of certain assets. You calculate the yearly deduction by multiplying a fraction by the asset cost. Buildings and leasehold improvements are depreciated over 7 to 40 years. That’s cash that can be put to work for future growth or bigger dividends to owners. The time value of money is that, in most cases, a dollar today is more valuable than a dollar in the future.

Straight Line Depreciation Method Examples

Depreciation impacts a company’s income statement, balance sheet, profitability and net assets, so it’s important for it to be correct. Then, you would report the depreciation expense on your company’s annual income statement for five years. Under the straight-line method, the machine would depreciate by $200 per year. Straight-line depreciation is more simple than the declining balance method.

Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset. Salvage Value Of The AssetSalvage value or scrap value is the estimated value of an asset after its useful life is over. For example, if a company’s machinery has a 5-year life and is only valued $5000 at the end of that time, the salvage value is $5000.

What is the Straight Line Depreciation Method?

The difference in value between a never-owned car and a one-year-old car is vast, while the difference between a six-year-old car and a seven-year-old car is much narrower. Straight-line depreciation assumes that the asset declines by the same amount every year. That makes it simple to calculate, but not always the most accurate way to depreciate an asset. Uncle Sam is going to celebrate too, after collecting taxes from you. For tax preparation purposes, you need to know exactly what you can and can’t deduct for depreciation. Beyond keeping you out of prison and audit nightmares, understanding depreciation will help you forecast your taxable income and deductions.

- If we estimate the salvage value at $3,000, this is a total depreciable cost of $10,000.

- Still, the straight-line depreciation method is widely employed for its simplicity and functionality to determine the depreciation of assets being used over time without a particular pattern.

- In our explanation of how to calculate straight-line depreciation expense above, we said the calculation was (cost – salvage value) / useful life.

- It is the easiest and simplest method of depreciation, where the asset’s cost is depreciated uniformly over its useful life.

- Only tangible assets, or assets you can touch, can be depreciated, with intangible assets amortized instead.

- Companies might select the diminishing balance method for a tech asset whose company releases updated models every 10 years instead of every five.

- Should you use straight-line depreciation or an alternative method?

Existing accounting rules allow for a maximum useful life of five years for computers, but your business has upgraded its hardware every three years in the past. You think three years is a more realistic estimate of its useful life because you know you’re likely going to dispose of the computer at that time.